When it comes to protecting your vehicle, having the right auto insurance is just as important as maintaining your car. But with so many coverage options available, it’s easy to get confused—especially when it comes to comprehensive and collision coverage.

Both comprehensive and collision insurance provide essential protection, but they cover different types of damage. Understanding how they work can help you decide if you need one, both, or neither. In this guide, we’ll break down the differences, what each covers, and whether you should add them to your policy.

What is Collision Coverage?

Collision insurance covers damage to your vehicle if you're involved in an accident, regardless of who is at fault. It’s designed to pay for repairs or replacement if your car is damaged in a crash.

✅ What Collision Coverage Covers:

- Accidents involving another vehicle (regardless of who caused the crash).

- Collisions with objects such as guardrails, poles, fences, or buildings.

- Single-vehicle accidents, like rolling over or hitting a pothole.

- Hit-and-run accidents, depending on the policy terms.

❌ What Collision Coverage Does NOT Cover:

- Damage from theft, vandalism, or natural disasters (this falls under comprehensive coverage).

- Injuries or medical bills (covered by personal injury protection or health insurance).

- Damage to another driver’s vehicle (covered by liability insurance).

💡 Who Needs Collision Insurance?

- Drivers with a financed or leased vehicle (often required by lenders).

- Owners of newer or high-value vehicles who want full protection.

- Anyone who can’t afford to pay out-of-pocket for major repairs after an accident.

What is Comprehensive Coverage?

Comprehensive insurance covers damage to your vehicle that is NOT caused by a collision. It protects against theft, vandalism, and natural disasters—things beyond your control.

✅ What Comprehensive Coverage Covers:

- Theft & Vandalism – If your car is stolen or broken into.

- Fire Damage – Covers repairs or replacement if your car is damaged in a fire.

- Natural Disasters – Protects against hurricanes, tornadoes, earthquakes, and floods.

- Falling Objects – Includes damage from trees, hail, and debris.

- Animal Collisions – If you hit a deer or other wildlife.

- Glass Damage – Covers broken windshields (some insurers offer separate glass coverage).

❌ What Comprehensive Coverage Does NOT Cover:

- Damage from a car accident (covered by collision insurance).

- Medical expenses (covered by personal injury protection or health insurance).

- Damage to another vehicle or property (covered by liability insurance).

💡 Who Needs Comprehensive Insurance?

- Drivers who live in areas prone to natural disasters or theft.

- Owners of expensive or new vehicles who want full protection.

- Anyone who wants added peace of mind against unexpected damage.

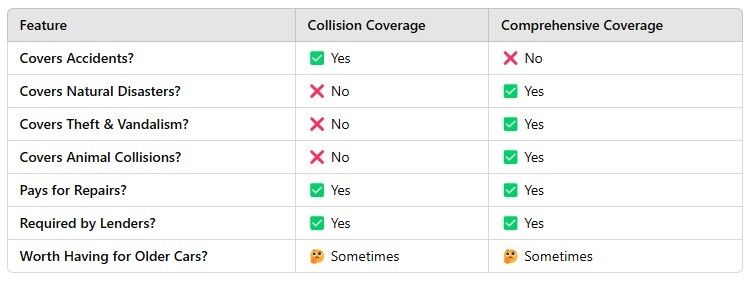

Key Differences: Comprehensive vs. Collision Insurance

Do You Need Both Comprehensive & Collision Insurance?

For most drivers, the best protection comes from having both types of coverage—especially if your vehicle is new or valuable. However, there are cases where you might not need both.

✅ Get Both if:

- Your car is less than 10 years old or worth over $5,000.

- You can’t afford to replace your car if it’s totaled.

- You live in an area with high accident rates or extreme weather.

❌ Consider Dropping One or Both if:

- Your car is older and worth less than $2,000.

- The annual cost of coverage is more than 10% of your car’s value.

- You have enough savings to cover repair or replacement costs out-of-pocket.

Final Thoughts: Protect Your Ride with the Right Coverage

When it comes to auto insurance, understanding the difference between comprehensive and collision coverage is key to making the right decision.

💡 Collision coverage protects your vehicle when you crash into something.

💡 Comprehensive coverage protects your vehicle when something unexpected happens (theft, weather, fire, animals).

Together, they offer full protection for your vehicle, ensuring you’re covered no matter what happens on the road or in your driveway.

🔹 Need help choosing the right auto insurance? Contact us today for a free quote and expert advice!

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.