Running a business comes with risks—whether you’re a small startup, contractor, or large corporation, unexpected incidents can lead to costly lawsuits and financial setbacks. That’s where General Liability Insurance steps in as a critical layer of protection.

From customer injuries to property damage and advertising disputes, this coverage helps shield your business from financial losses that could otherwise be devastating. In this guide, we’ll explore what General Liability Insurance covers, why it’s essential, and how it safeguards your business from common risks.

What is General Liability Insurance?

General Liability Insurance (GLI) is a core business insurance policy that protects companies from a range of legal and financial liabilities. It covers expenses related to:

✅ Bodily Injuries – If a customer or visitor gets hurt on your business premises.

✅ Property Damage – If your business accidentally damages someone else’s property.

✅ Personal & Advertising Injury – If your business is accused of libel, slander, or copyright infringement.

✅ Legal Defense Costs – Covers attorney fees, settlements, and court costs if your business is sued.

Whether you own a brick-and-mortar store, work as a contractor, or provide professional services, General Liability Insurance helps protect you from unexpected claims that could otherwise drain your finances.

Why Every Business Needs General Liability Insurance

Many business owners assume they don’t need insurance until something happens—but by then, it’s too late. Here’s why General Liability Insurance is essential for any business, no matter the industry:

1. It Protects Against Costly Lawsuits

In today’s litigious world, even a minor incident can turn into a lawsuit. Whether a customer slips and falls in your store or you’re accused of damaging a client’s property, legal defense costs alone can cripple a business financially. GLI covers these expenses, helping businesses stay afloat during legal battles.

2. It Builds Trust with Clients & Partners

Many clients and vendors require proof of insurance before doing business with you. Having General Liability Insurance demonstrates professionalism and reliability, making your business more attractive to potential customers and partners.

3. It’s Often Required by Law or Contracts

Some states, landlords, and business contracts mandate liability coverage before you can legally operate or lease commercial space. Without insurance, you may lose out on contracts or face legal penalties.

4. It Covers Unintentional Advertising Mistakes

If your business is accused of copyright infringement, defamation, or false advertising, legal action can follow. General Liability Insurance helps cover settlements and legal fees related to advertising claims, protecting your brand from reputational and financial harm.

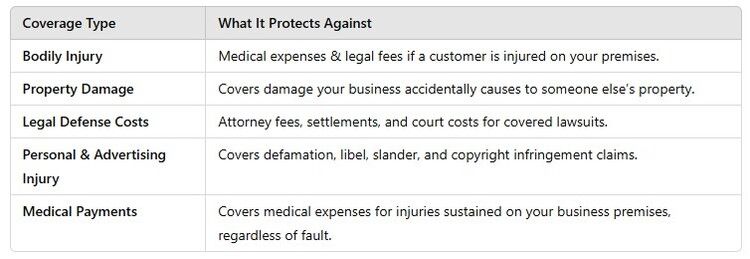

What Does General Liability Insurance Cover?

General Liability Insurance provides broad coverage for common risks businesses face daily. Here’s a breakdown of what it typically covers:

While this coverage is extensive, it doesn’t cover everything—for example, employee injuries (covered by Workers’ Compensation Insurance) or professional errors (covered by Professional Liability Insurance).

Who Needs General Liability Insurance?

Almost every business, regardless of size or industry, can benefit from General Liability Insurance. However, it’s particularly important for:

🏢 Retail Stores & Restaurants – Protects against customer injuries, spills, and property damage.

🔨 Contractors & Tradespeople – Many contracts require proof of insurance before starting work.

📦 Manufacturers & Distributors – Protects against product liability claims and damage to third-party property.

💼 Consultants & Service-Based Businesses – Defends against claims of advertising injuries or accidental property damage.

🏗 Commercial Property Owners – Required by landlords before leasing a space to tenants.

If your business interacts with customers, operates in a physical space, or markets itself online, General Liability Insurance is a must-have protection.

How Much Does General Liability Insurance Cost?

The cost of General Liability Insurance varies based on several factors, including:

📍 Industry & Risk Level – High-risk industries (e.g., construction) pay more than low-risk businesses (e.g., online consulting).

🏢 Business Size & Revenue – Larger businesses with more foot traffic or higher sales may have higher premiums.

📍 Coverage Limits – Higher coverage amounts result in slightly higher costs.

On average, small businesses pay between $40-$75 per month for a basic General Liability Insurance policy. However, the cost is far less than the potential financial damage from a single lawsuit.

Final Thoughts: Secure Your Business & Thrive

General Liability Insurance isn’t just an extra expense—it’s an investment in your business’s long-term security. Whether it’s protecting against accidents, lawsuits, or advertising claims, this coverage ensures your business can operate with confidence and financial stability.

🔹 Ready to safeguard your business? Get a free General Liability Insurance quote today and stay protected from unexpected risks.

At Freedom Insurance Group, Inc., we aim to provide comprehensive insurance policies that make your life easier. We want to help you get insurance that fits your needs. You can get additional information about our products and services by calling our agency at 828-322-7474. Get a free quote today by CLICKING HERE.

Disclaimer: The information presented in this blog is intended for informational purposes only and should not be considered as professional advice. It is crucial to consult with a qualified insurance agent or professional for personalized advice tailored to your specific circumstances. They can provide expert guidance and help you make informed decisions regarding your insurance needs.